How Do You Calculate Return on Investment (ROI) in Real Estate? | Partner Driven

At Partner Driven, we understand that calculating Return on Investment (ROI) is crucial for making informed real estate investment decisions. ROI is a key metric for evaluating a property’s profitability, helping determine whether your investment is worthwhile. Whether you’re flipping homes, renting properties, or using leverage to finance your deals, knowing how to calculate ROI is essential for maximizing your returns. In this guide, we’ll explain how to calculate ROI for different real estate investments, explore the factors that affect it, and show you how Partner Driven can help you achieve the best possible returns.

Why Is Calculating ROI Important for Real Estate Investors?

ROI is a financial tool that helps investors assess the profitability of a real estate investment. Without knowing your ROI, evaluating how well an investment is performing or meeting your financial goals is hard. Calculating ROI allows you to compare properties, weigh investment opportunities, and make smart, data-driven decisions about which properties to buy, hold, or sell.

At Partner Driven, we make it easy to understand ROI and ensure you have the right tools to evaluate the performance of your real estate investments. Maximizing ROI is fundamental to growing a successful portfolio, and our team is here to guide you every step of the way.

How Do You Calculate ROI for Real Estate Investments?

The formula for calculating ROI in real estate is simple but highly effective. It can be adjusted depending on whether you’re flipping a property or earning rental income. Here’s the basic formula:

In this formula, your Net Profit is the total amount earned from the investment (whether from the sale price or rental income) minus all associated costs, such as property purchase, closing fees, renovation expenses, and maintenance. The Total Investment includes the purchase price and all related costs incurred during the investment.

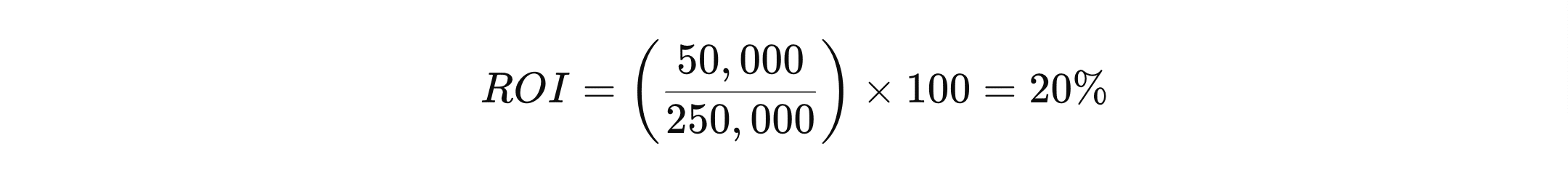

For example, if you purchase a property for $200,000, spend $50,000 on renovations, and sell it for $300,000, your net profit is $50,000. Using the formula:

This calculation shows that your investment delivered a 20% return, a solid outcome that helps you understand the overall profitability of your deal.

How Do You Calculate ROI for Rental Properties?

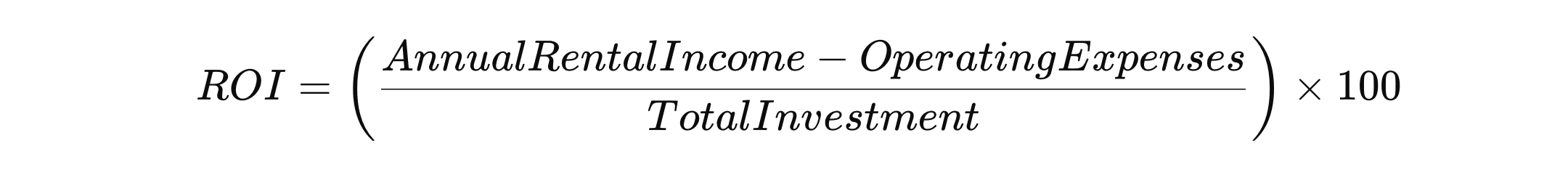

Rental properties generate long-term returns through consistent rental income. Calculating rental ROI requires factoring in your annual cash flow (rental income) and deducting your operating expenses. The formula for rental properties is:

- Annual Rental Income is the total income generated from tenants over the year.

- Operating Expenses include property management fees, maintenance, repairs, insurance, and property taxes.

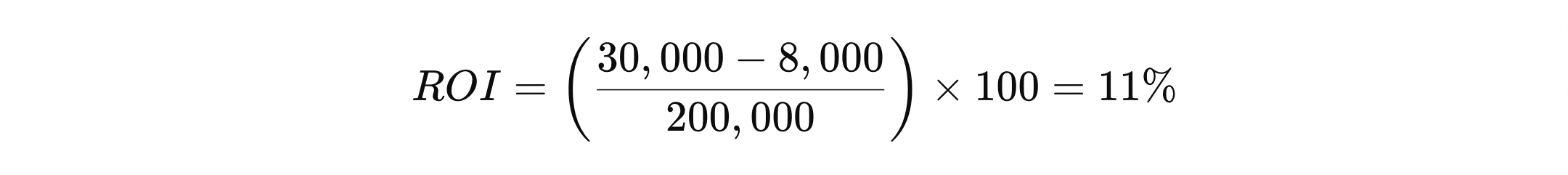

For instance, if your rental property generates $30,000 in rental income annually and you have $8,000 in operating expenses, with an initial investment of $200,000, your ROI would be:

This shows that your rental property generates an 11% return annually, which provides a good indication of its financial performance, excluding potential property appreciation.

What Is ROI with Leveraged Financing?

Many investors use leverage to finance their real estate purchases, which involves borrowing money (such as a mortgage) to buy a property. In this case, the ROI is calculated based on the amount of cash you’ve invested (such as your down payment) rather than the total property value. This is how the formula changes:

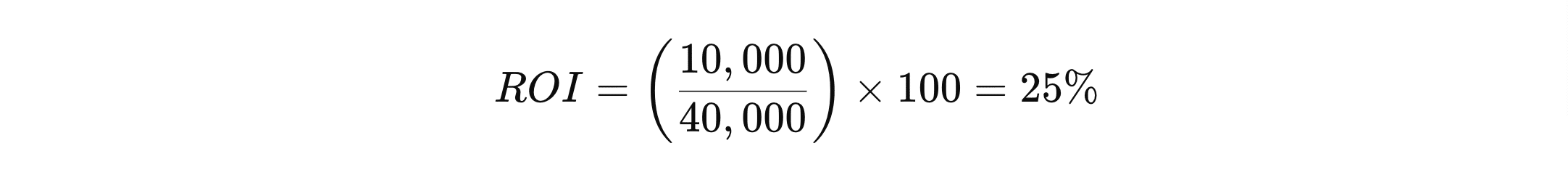

For example, if you put down $40,000 as a down payment and the property generates $10,000 in annual rental income after expenses, your ROI would be:

Using leverage can significantly increase your ROI because you’re using less of your own money. However, this comes with more risk, as loan payments and interest expenses must be factored into your overall cash flow. At Partner Driven, we help you assess the right financing strategy to ensure your ROI remains strong while managing risks.

What Factors Impact ROI in Real Estate?

Several factors can influence your ROI and ultimately determine the success of your real estate investment. Let’s look at a few key factors:

How Does Location Impact ROI?

Location is one of the most significant factors that affect ROI. Properties in high-demand areas with access to amenities, good schools, and transportation hubs are more likely to appreciate value and command higher rental prices. On the other hand, properties in low-demand areas may struggle to attract tenants or appreciate over time, which can negatively impact your ROI. At Partner Driven, we provide market analysis tools that help you assess a property’s location and ensure that you invest in areas with strong growth potential and demand. The right location can significantly increase your long-term returns.

How Do Renovation Costs Affect ROI?

Renovating a property can add value and increase its market appeal, but overspending on unnecessary upgrades can hurt your ROI. It’s important to focus on improvements that offer the best return, such as kitchen and bathroom upgrades, energy-efficient windows, or exterior enhancements. At Partner Driven, we help you make strategic renovation decisions that improve your property’s value without eroding your profit margins.

How Do Market Trends Influence ROI?

Market trends also play a major role in determining ROI. A rising real estate market can boost property values, while a downturn can reduce profitability. Keeping an eye on local and national trends is essential for timing your investments and maximizing your ROI. Partner Driven offers insights and market data to help you stay ahead of these trends and adjust your strategy as needed.

How Does Partner Driven Help You Maximize ROI?

At Partner Driven, we aim to help you achieve the highest possible returns on your real estate investments. We don’t just teach you how to calculate ROI—we partner with you to develop tailored investment strategies that align with your financial goals. With our coaching, financing, and personalized guidance, you’ll have the tools to make smart investment choices.

We work with you to analyze potential properties, calculate expected returns, and avoid common pitfalls that could reduce your profitability. Whether you’re interested in rental properties, fix-and-flip projects, or leveraging financing to grow your portfolio, Partner Driven ensures you’re fully supported every step of the way.

Ready to Maximize Your ROI with Partner Driven?

Understanding how to calculate ROI is vital for any successful real estate investor. At Partner Driven, we make the process easy by providing expert coaching and the right tools, especially for new real estate investors to assess your returns. By partnering with us, you’ll gain access to financing, market insights, and personalized strategies that help you get the best possible returns on your real estate investments. Ready to improve your ROI and achieve your financial goals? Schedule a call with Partner Driven today, and let us help you navigate your next investment with confidence and success.

FAQs about Real Estate Investing

About Partner Driven Real Estate Investing

Partner Driven Real Estate Investing is a nationwide leader in real estate investment, offering a unique and comprehensive approach to learning and succeeding in real estate investing. Founded by industry experts Peter Vekselman and Julie Muse, Partner Driven combines advanced technology, full funding, expert mentorship, and collaborative partnerships to empower individuals & give them the resources to achieve their real estate investment goals.

Our Services

- Real Estate Coaching: We provide personalized mentorship from seasoned industry professionals, guiding you through every step of the investment process. Our coaches help you understand market analysis, property evaluation, and practical investment strategies.

- Full Funding: One of our key offerings is providing capital for real estate deals. This eliminates financial barriers and allows you to focus on identifying and negotiating profitable investment opportunities without the stress of securing funding.

- Advanced Software: Our state-of-the-art software helps you identify lucrative off-market deals, giving you a competitive edge. This tool streamlines finding, evaluating, and capturing potential investment properties.

- Property Acquisition: We assist you in acquiring properties, ensuring that all legal and financial aspects are handled efficiently. Our team supports you in making informed decisions and securing the best deals.

- Risk Mitigation: Partner Driven takes on the financial risk, allowing you to invest confidently. Our expert team provides comprehensive risk assessment and management strategies to protect your investments.

- Profit Sharing: Our unique profit-sharing model ensures you benefit directly from each deal’s success. We split the profits 50-50, reflecting our commitment to mutual success.

- Educational Resources: Through Partner Driven University, you can access our extensive library of resources, including online courses, webinars, and training materials. Learn the latest trends, techniques, and best practices in real estate investing.

- Real Estate Workshops: Participate in our interactive workshops and seminars to gain hands-on experience and network with other investors. These events are designed to enhance your knowledge and skills in real estate investing.

- Collaborative Network: Join our dynamic community of investors, mentors, and industry professionals. Our network provides opportunities for collaboration, partnership, and continued learning.

- Nationwide Presence: With a nationwide reach, Partner Driven Real Estate Investing operates across diverse markets, providing localized support and insights to help you succeed wherever you are.

Our Mission

At Partner Driven, our mission is to revolutionize real estate investing by offering unparalleled support, resources, and opportunities. We are dedicated to helping you learn real estate investing through hands-on partnerships, ensuring you have the knowledge, funding, and guidance needed to thrive in the competitive real estate market.

Contact Us

Ready to start your real estate investing journey? Visit Partner Driven to learn more about our services and how we can help you achieve your investment goals. Connect with us on social media and join our community of successful real estate investors today!