Partner Driven Deal Spotlight

Rehab Deal in Lake Villa, IL: A Premier Real Estate Investment for Maximum ROI

PARTNER | MH Property Solutions

ADDRESS | N Deerview Dr, Lake Villa, Illinois

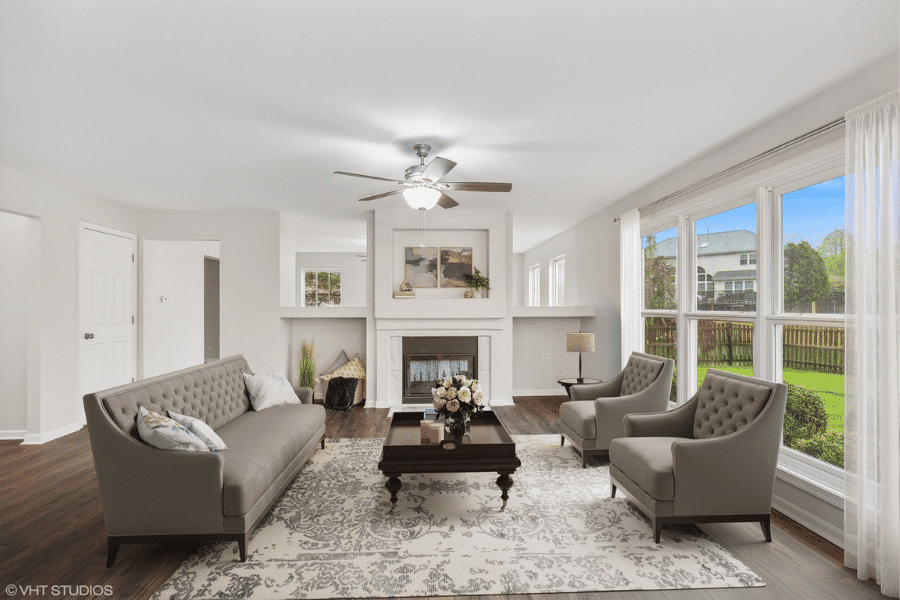

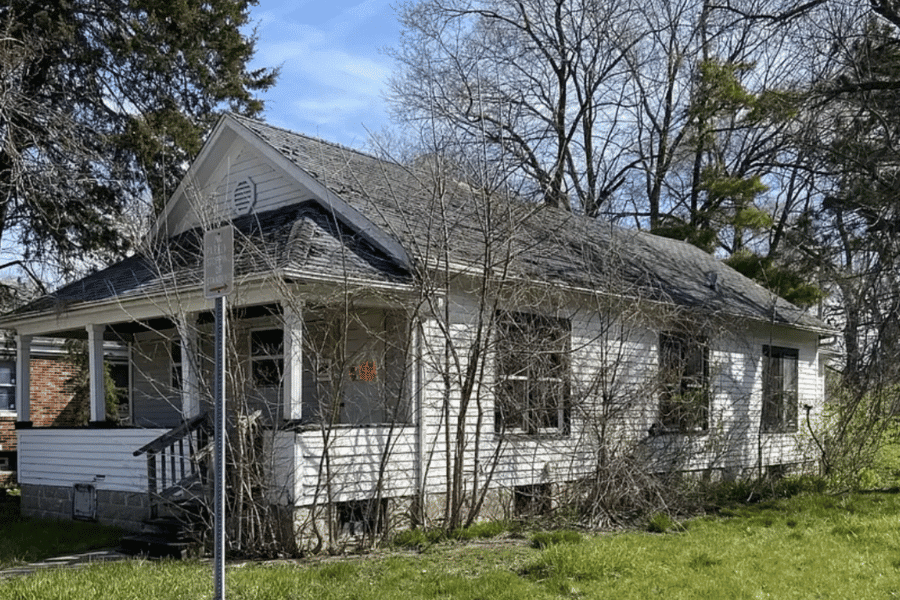

Partner Driven, in collaboration with MH Property Solutions, successfully completed a fix-and-flip on North Deerview Dr, Lake Villa, IL 60046. We purchased the home on 3/15/2023 for $268,750, invested $60,000 in renovations, and sold it for $430,000 on 8/15/2023. This deal showcased our effective renovation strategy and commitment to delivering profitable outcomes. The partnership with MH Property Solutions exemplified our collaborative approach to maximizing property value through strategic investments.

Frequently Asked Questions About Rehabbing Real Estate

Rehabbing a property involves purchasing a distressed or outdated home, making necessary repairs and upgrades, and then selling it for a profit. Depending on the property’s condition and market demand, this process can range from cosmetic updates to major structural renovations.

Rehabbing refers to renovation while flipping involves buying, rehabbing, and selling the property. In a flip, the goal is to increase the property’s value through repairs and improvements so that it can be sold for a higher price.

A rehab project can be financed through various methods, such as hard money loans, private lenders, traditional bank loans, or partner funds. Some investors also use their savings or seek rehab-specific loans like FHA 203(k) for properties needing renovation. Partner Driven can fund the project for you!!

Key steps include property inspection, budgeting for repairs, obtaining necessary permits, hiring contractors, managing the renovation process, and staging the property for sale. Successful rehabbing requires careful planning, cost management, and time efficiency.

Standard rehab costs include repairs to the roof, electrical systems, plumbing, kitchen and bathroom remodels, flooring, paint, and landscaping. Also, fees may be associated with permits, labor, and unforeseen structural issues during rehab.

To estimate the ARV, you must evaluate comparable sales (comps) in the area and similar properties recently sold after renovation. Analyzing these properties indicates the price you can expect to sell your property for once the rehab is complete.

Risks include underestimating rehab costs, overestimating the after-repair value (ARV), unexpected delays, changes in the real estate market, or problems with contractors. These factors can affect profitability, making proper planning and contingency budgeting essential.

The rehab and flip project timeline can vary widely depending on the property’s condition, the extent of repairs, and how quickly you can sell the property. On average, a flip can take 3 to 12 months but may take longer if unforeseen issues arise.

Properties suitable for rehabbing are often found through foreclosures, auctions, real estate wholesalers, distressed property listings, and off-market deals. Networking with other investors and real estate agents and using tools to find distressed properties are effective methods to source good deals.

Partner Driven provides mentorship, financial backing, and expert guidance for real estate investors rehabbing and flipping properties. From evaluating the after-repair value (ARV) to managing renovations and finding buyers, Partner Driven offers support to ensure profitability and minimize risks throughout the process.

About Partner Driven Real Estate

Partner Driven Real Estate Investing is a nationwide leader in real estate investment, offering a unique and comprehensive approach to learning and succeeding in real estate investing. Founded by industry experts Peter Vekselman and Julie Muse, Partner Driven combines advanced technology, full funding, expert mentorship, and collaborative partnerships to empower individuals & give them the resources to achieve their real estate investment goals.