Partner Driven Deal Spotlight

Wholesale Real Estate Success in Bluefield, Virginia: A Profitable Investment with Partner Driven

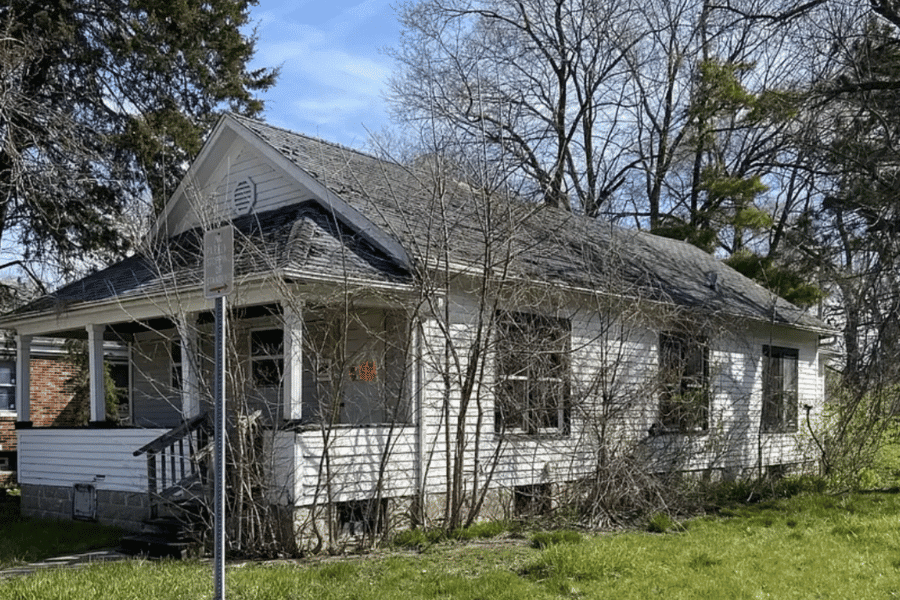

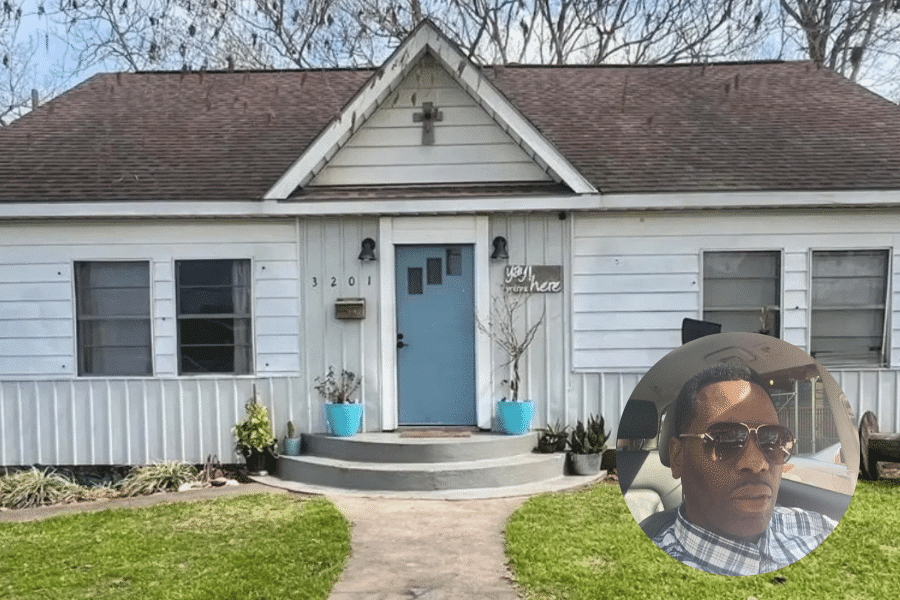

PARTNER | Fallon Poole

ADDRESS | McDonald St, Bluefield, Virginia

At Partner Driven, we’re excited to share the success story of our recent quick flip in collaboration with our esteemed partner, Fallon Poole. This transaction highlights our ability to efficiently execute high-return opportunities through smart investments and strategic partnerships.

The Property and Transaction Details

On July 1, 2024, we purchased a property on McDonald St, Bluefield, VA, for $10,000. Utilizing our market knowledge and strategic approach, we successfully sold the property the same day for $25,000. This quick flip demonstrated our ability to turn a modest investment into a profitable transaction, underscoring the value of swift decision-making and effective partnerships.

The Power of Quick Flips

In real estate, speed and strategy are key to maximizing returns, especially with smaller investments. By identifying opportunities with high potential and leveraging market insights, we’re able to act quickly and efficiently to deliver profitable outcomes for our partners and stakeholders.

Frequently Asked Questions About Wholesaling a Real Estate Deal

Wholesaling in real estate is when an investor (the wholesaler) contracts a property from a seller and then assigns that contract to a buyer for a profit. The wholesaler doesn’t typically purchase the property but makes money by finding a buyer willing to pay more than the contract price.

A wholesaler earns money by selling the rights to a property contract to a buyer at a higher price than the original agreement. The difference between the contract price and the price paid by the buyer is the wholesaler’s profit, often referred to as the assignment fee.

In most states, you don’t need a real estate license to wholesale properties. However, some states may have specific regulations regarding how wholesalers conduct business, so it’s essential to understand local laws.

An assignment of contract is the legal process allowing wholesalers to transfer their contractual rights to purchase a property to another buyer. The wholesaler acts as the intermediary and assigns the contract to the end buyer, often for a fee.

Wholesalers typically find properties through various methods, such as driving for dollars, searching foreclosure listings, using real estate marketing tools, or networking with motivated sellers and investors. Off-market properties and distressed homes are common targets for wholesale deals.

Some risks include not finding a buyer before the contract expires, underestimating repair costs, or overestimating the property’s value. Additionally, failing to follow legal guidelines for wholesaling could lead to issues with contract enforcement.

The timeline for wholesaling can vary. It can take as little as a few weeks or up to a few months, depending on how quickly a wholesaler finds a buyer, how motivated the seller is, and the contract terms.

A double closing is when a wholesaler purchases the property and immediately sells it to another buyer, usually on the same day. This can be useful if the end buyer doesn’t want to know the profit margin the wholesaler is making.

Yes, wholesaling typically requires little to no upfront investment because you do not purchase the property; you only assign the contract. However, some deals may require earnest money to secure the contract.

Partner Driven offers mentorship, financial backing, and expert guidance throughout wholesaling. From finding off-market deals to assigning contracts, Partner Driven helps wholesalers navigate the complexities of real estate investing while minimizing risk.

More Deals with Partner Driven

About Partner Driven Real Estate

Partner Driven Real Estate Investing is a nationwide leader in real estate investment, offering a unique and comprehensive approach to learning and succeeding in real estate investing. Founded by industry experts Peter Vekselman and Julie Muse, Partner Driven combines advanced technology, full funding, expert mentorship, and collaborative partnerships to empower individuals & give them the resources to achieve their real estate investment goals.